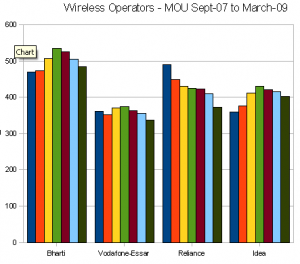

Vodafone Essar’s rev/min declined 2.3% qoq and MoU declined 5.6% qoq. This also confirms a trend – MoU/ARPU hit has been more for operators with greater metro/urban presence. In case of Vodafone, lower roaming and diversion to RCOM’s free mins can be seen as the primary reason for the decline. The impact of free mins will likely reduce in 1QFY10 and usage could also be boosted by electoral activity 🙂

Vodafone’s capex was Rs102bn for FY09, slightly higher than Bharti, and reflecting: narrowing of the coverage gap and upfront capex in new roll-outs.

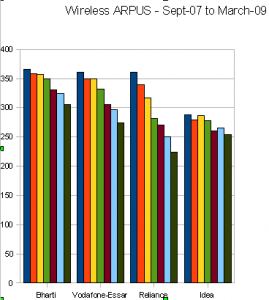

The following two charts show how ARPUS and MOUs have declined for Bharti Airtel, Vodafone India, Idea Cellular and Reliance Communications in between Sept-2007 and March-2009.