Before I write about the M&A in Indian Telecom, I’d like to write a little more on the evolution of Wireless Data / Broadband services.

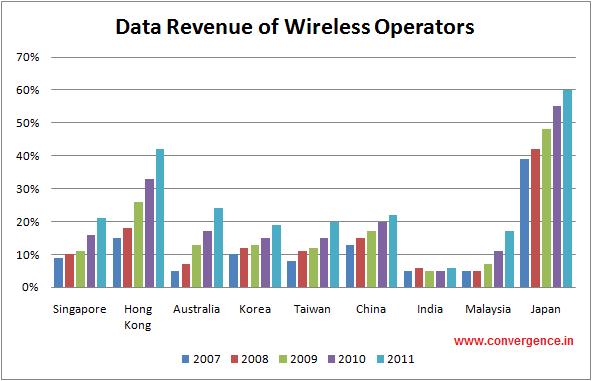

Investment Bankers and Strategists at Telecommunication companies are pitching that Data as the next Big driver for the sector, especially with the advent of cheaper access devices. Let us study the Rise of Data as Percentage of Revenues for Telcos in Asia Pacific – Singapore, Hong Kong, Japan, Korea, Taiwan, China and Malaysia. All these markets are ahead of India in the Telecom revolution and thus they have a lesson which Reliance / Mukesh Ambani and others can peruse through to learn from.

The following chart shows the combined Data revenues of Major Telcos in Asian Countries from 2007-2011. [You can expect minor margin of error]

Singapore & Hog Kong – Data growth has increased significantly from the trough of FY09 with the launch of SmartPhones and c75% of new / recontracts on smart devices.

Korea & Taiwan – Take-up in data was most pronounced from FY10 as more data-ready handsets were introduced.

Japan – Voice ARPU declined by price cuts and decreased MOU. They have Flat Unlimited Data Plans thus upside for Telcos is capped.

China – Data has grown significantly, but overall industry ARPUs don’t reflect rising trends, indicating scope for substitution of voice. [This is in-line with my yesterday’s projection that

In addition, this would significantly impact the voice revenues of the incumbents.

India – Data growth also remains subdued given limited consumer wallet and low technology literacy. Disruptive Application and Web Platforms can change the trend to some extent thus cutting the revenue streams of incumbent Telecom players and shift the money from Voice to Data.

Developed Markets have seen revenue improvements linked to data demand, as evidenced by the smartphone and connected devices take-up. Emerging Market telcos may not necessarily face similar trends given the much smaller wallets and greater chance for voice / SMS substitution. Going by Business Case Analysis – Data, in my view, may be a risk for Emerging Markets earnings rather than an opportunity in the near term [2 years] which I have already said is when Reliance & Mukesh Ambani will burn the cash earned from KG-D6 Oil basin 🙂

Finally, I am tired of the flip-flop policies of Government, incompetent bureaucracy and equally bad Regulator (TRAI) which can be a game changer with massive Corruption and Scam 🙂