Indian Wireless Connections net-adds for Jun 2010 stood at 18.1m, ~11% higher than 16.3m in May 2010. Net-adds of incumbeant operators (Bharti, RCom, Vodafone, TTSL, Aircel) were largely stable. Aggregate subscriber base stood at 630m (+49% yoy), as at end- Jun – 2010.

Amongst the new operators, Uninor is gaining traction with launch in 6 new circles taking the total service availablity to 14 circles and a net add of 1 mn connections in June-10. Uninor’s Operating Metrics and CAPEX plans are available here as a part of Telnor disclosure. Videocon’s net-adds dipped 22% mom to 0.55m.

Idea Cellular’s net-adds jumped 50% mom to 2.1m in Jun ’10, driven by new circles – Mumbai, Bihar, and seven others (where Idea launched operations over the past year); net-adds in the new circles rose nearly 5x mom to 0.78m. Idea’s relatively lower net-adds reflect a more-focused rollout in new circles, lower tariff discounting vis-a-vis RCom/Tata and tighter subscriber recognition norms.

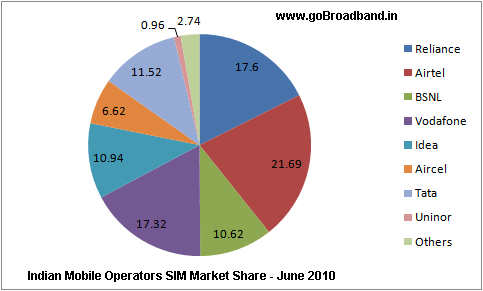

Wireless Subscriber / Connection Market Share in India at the End of June-2010:In June 2009, the wireless connections in India were 422 Mn which has now jumped to 630 Mn. The market share of various operators is as below.