After 12 days and 70 rounds of bidding on Friday (April 23), 3G bid-price of US$1.71bn (Rs76bn) is almost at my forecast of $1.8 bn and is likely to cross the same, a bad thing for the Indian Wireless Industry as a whole. With Activity requirement still at 80% in our view, the risk of final price surpassing US$2bn mark have increased considerably. This raises the doubt of value creation from 3G if winning bid exceeding US$2bn, and therefore expect weakness with incumbent operators as well.

Aggregate bid amount in Metro+A circles has crossed US$1.25bn (75% of pan India). The activity threshold of 80% allows bidders to skip ‘B’ and ‘C’ circles for now, without any loss of eligibility points.

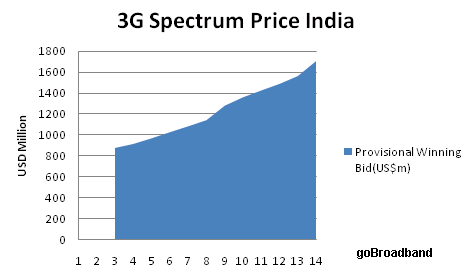

The reduction in the number of 3G spectrum blocks to 3 from 4 has combined with lack of a future spectrum roadmap, and the strategic value of 3G spectrum (ahead of MNP implementation), are pushing the operators to bid aggressively.  The following chart shows the increase in price for All India 3G Spectrum from Day 1 through Day 12 of the auction which has increased from USD 880 mn to USD 1.7 Bn

The following chart shows the increase in price for All India 3G Spectrum from Day 1 through Day 12 of the auction which has increased from USD 880 mn to USD 1.7 Bn

Without any doubt, this bidding will put pressure on incumbent operators as well and will end the Tariff War for now. Who knows they may rise a bit from here, any guess ?

i dont think 3g auction will end the tariff war because it was started by new operators and i dont think any new operator will win the auction. post 3g auction non 3g non 3g operators will have nothing but tariff to offer.