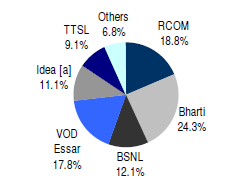

Aggressive marketing tactics has worked at RCom as the company is all set to take-off in adding more GSM subscribers to its platform. At the end of March-09 [FY 09] Reliance Communications wireless subscribers market share went up to 18.8% from 17.9% in Dec-08. Airtel lost its subscriber market share from 25% to 24.3%. In Jan, Bharti Airtel executives had downplayed RCom’s GSM launch and I am sure they have woken up atleast now. Airtel is still leading in ARPU / Revenue market share but the equation is fast changing out of its favor and the company needs to address this with urgency.

Vodafone, Idea Cellular and BSNL India havae managed to maintain their market share on a QoQ basis. Tata Indicom / Telservices has seen a drop from 9.3% to 9.1% in the past quarter. Industry net-adds were 130m in FY09 (10.8m per month) vs. 95m in FY08. At the end of March-09, India’s Mobile / Wireless Subscriber base stands at 386 mn [GSM + CDMA] Stay tuned for more on Bharti Airtel and Reliance Communications.

Vodafone, Idea Cellular and BSNL India havae managed to maintain their market share on a QoQ basis. Tata Indicom / Telservices has seen a drop from 9.3% to 9.1% in the past quarter. Industry net-adds were 130m in FY09 (10.8m per month) vs. 95m in FY08. At the end of March-09, India’s Mobile / Wireless Subscriber base stands at 386 mn [GSM + CDMA] Stay tuned for more on Bharti Airtel and Reliance Communications.

Broadband Subscriber base in India touched 6.2 mn at the end of March-09. YoY basis the growth has slowed down from 66.66% recorded between March 2007-08 to 59.48% between March-2008-09. However, with the launch of EVDO and auction of 3G, broadband penetration should accelerate as Telcos will want to improve their bottomline.